fulton county ga vehicle sales tax

This calculator can estimate the tax due when you buy a vehicle. Complete a Bill of Sale you can use Form T-7 Bill of Sale.

Fulton Giving Property Owners Until Aug 5 To Appeal Tax Assessments Neighbornewsonline Com Suburban Atlanta S Local Mdjonline Com

Subject to the pricevalue of the vehicle.

. Fulton County Vehicle Services. The Georgia state sales tax rate is currently 4. Get a Vehicle Out of Impound.

There are a total of 476 local tax jurisdictions across the state collecting an average local tax of 3683. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. Get a Vehicle Out of Impound.

There is also a local tax of between 2 and 3. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. SUT-2017-01 New Local Taxes 13182 KB.

SW Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. For TDDTTY or Georgia Relay Access. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day.

Lowest sales tax 6 Highest sales tax 9 Georgia Sales Tax. 800 replacement fee plus manufacturing fees ranging from 2500 to 3500. A county-wide sales tax rate of 26 is applicable.

Fulton County Property and Vehicles. Fulton County Initiatives Fulton County Initiatives. GA 30303 404-612-4000 customerservicefultoncountygagov.

Sales Tax or Title Ad Valorem Tax TAVT Varies. To review the rules in Georgia visit our state-by-state guide. The Fulton County Sales Tax is 3.

Please type the text you see in the image into the text box and submit. You must cancel your registration within 30 days of cancelling insurance coverage to avoid fines and penalties related to Georgia law requiring insurance coverage. Tax Lien Sale Refunds.

Special handling fee for expedited title processing In-Person replacement titles and title corrections only 1000. Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4. Sales Tax Bulletin - New Atlanta and Fulton County Sales Taxes.

Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Kiosks will allow taxpayers to renew their vehicle registrations 24 hours a day 7 days a week. All taxes on the parcel in question must be paid in full prior to making a refund request.

Sales Tax Rates - General General Rate Chart - Effective April 1 2022 through June 30 2022 2219 KB General Rate Chart - Effective January 1. Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4. Automating sales tax compliance can help your business keep compliant.

Registration renewals at the kiosks have no additional charges for Fulton County residents. Other possible tax rates in Georgia include. 18 rows The Fulton County Sales Tax is 26.

Has impacted many state nexus laws and sales tax collection requirements. Taxpayer Refund Request Form. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. GA 30303 404-612-4000 customerservicefultoncountygagov.

Tax commissioner Property Taxes and Vehicle Registration 404-613-6100 141 Pryor Street SW Atlanta GA 30303. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

This tax is based on the value of the vehicle. Use Ad Valorem Tax Calculator. Please fully complete this form.

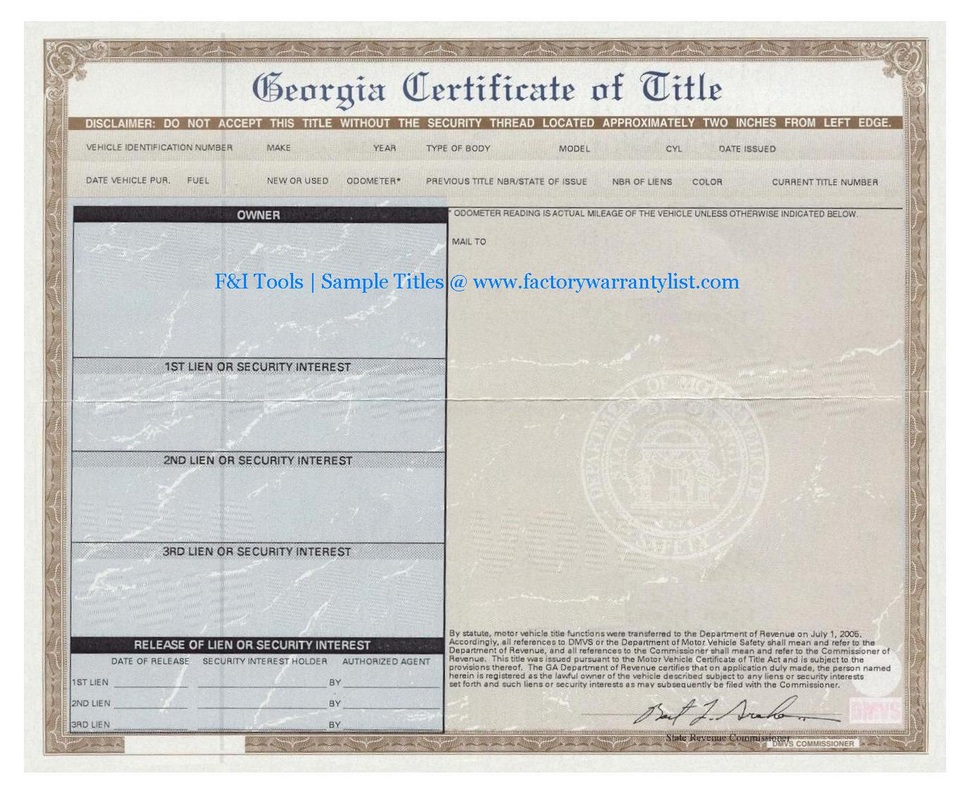

In addition to taxes car purchases in Georgia may be subject to other fees like registration title and plate fees. OFfice of the Tax Commissioner. The tax must be paid at the time of sale by Georgia residents or within six months of.

You can find these fees further down on the page. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

The Fulton County Sheriffs Office month of November 2019 tax sales. 6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state. Getting a Vehicle Out of Impound read More.

This is the total of state and county sales tax rates. Georgia collects a 4 state sales tax rate on the purchase of all vehicles. The kiosks are prominently located inside these high volume locations.

It is illegal for you to drive or allow someone else to drive a vehicle that is uninsured. The Georgia state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v.

Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA. Customer Service Center at Maxwell Road 11575 Maxwell Road Alpharetta GA 30009. Average Sales Tax With Local.

The Fulton County sales tax rate is 26. Property and Vehicles services.

Fulton County Tax Commissioner Office Greenbriar Mall

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Fulton County Ga Restaurants And Food Businesses For Sale Bizbuysell

What Is The Sales Tax Rate In Richmond County Ga Cubetoronto Com

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Ga Georgia On My Mind Fulton County Atlanta License Plate 65283qf 71 Ebay

Brookhaven Based Tax Office Relocating To Chamblee Next Week

Sales Tax On Cars And Vehicles In Georgia

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Fulton County Transportation Efforts To Continue Voters Extended Sales Tax Saportareport

Georgia Sales Tax Guide And Calculator 2022 Taxjar

Tax Commissioner S Office Cherokee County Georgia

Fulton County Georgia New Energy And A New Mission Aim To Complete The Picture In Greater Metro Atlanta Site Selection Online